Guide to Buying a Second Home and Renting the First

Investing In A Second Home And Renting The First

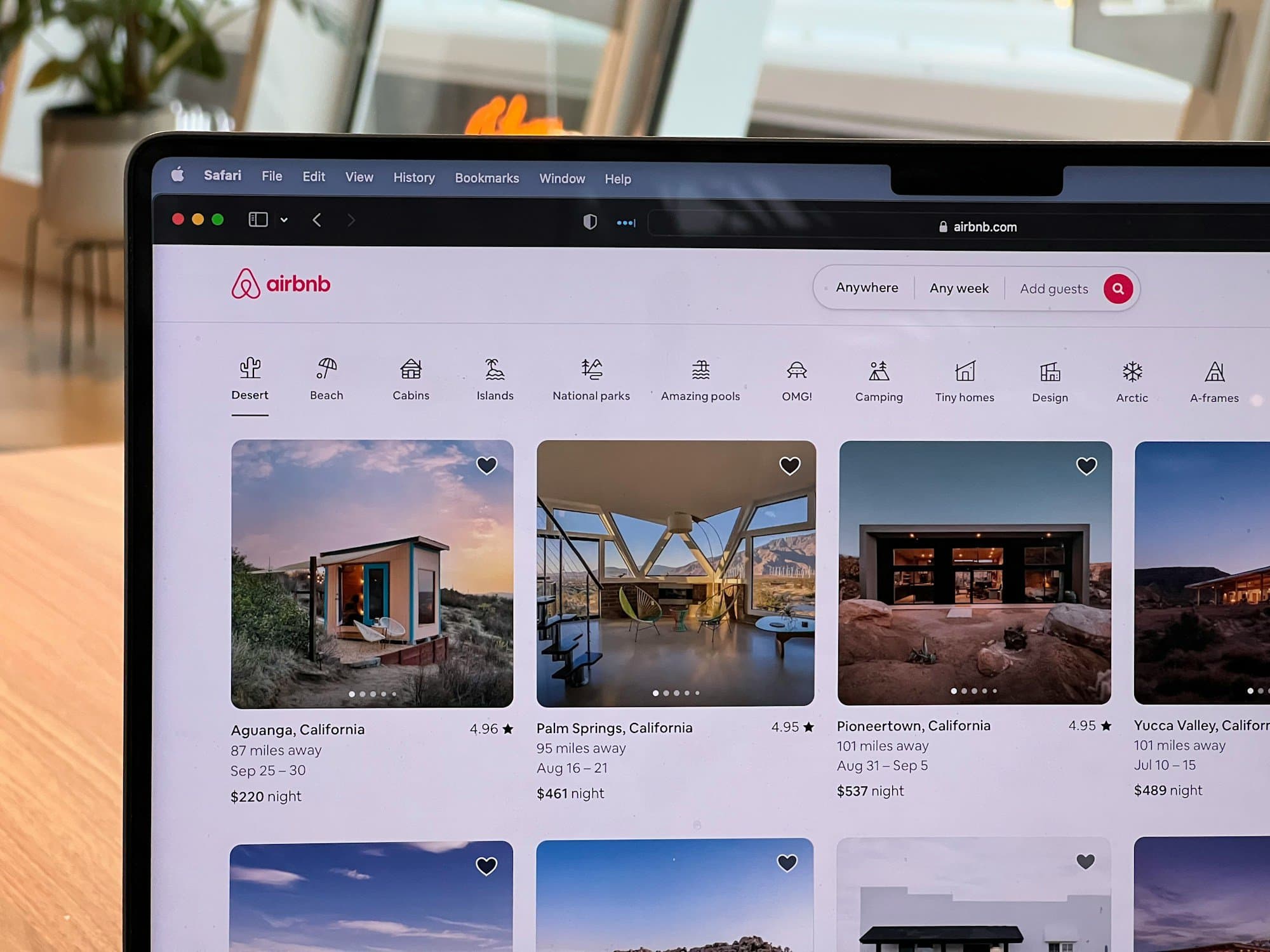

Buying a second home while renting out your first property can be a creative way to build wealth, generate passive income, and expand your real estate portfolio.

However, the real estate investing process involves careful planning, financial considerations, and an understanding of mortgage and tax implications. If you’ve ever asked, “Can you own a house and rent another?”, the answer is yes, but there are important factors to keep in mind.

This article will walk you through how to buy a second home and rent the first, covering financing, tax benefits, rental property management, and key challenges to consider.

1. Assessing Your Financial Readiness

Before jumping into buying a second home and renting the first, you need to evaluate your financial situation. Lenders have different requirements for financing a second home, and your ability to qualify will depend on your income, credit score, debt-to-income (DTI) ratio, and cash reserves.

Below are some key factors to consider:

- Credit Score: A strong credit score (typically 620+ for conventional loans) will help you secure better mortgage rates.

- Debt-to-Debt Ratio (DTI): Lenders prefer a DTI below 36%, including the monthly mortgage payments for both homes.

- Cash Reserves: Many lenders require you to have at least six months of mortgage payments in savings for both properties.

- Equity in Your First Home: If you have significant equity in your first home, you may be able to use a cash-out refinance or a home equity loan to help finance your second home purchase.

Before applying for a second mortgage, review your financial health and ensure you can comfortably handle the costs of both properties.

2. Financing a Second Home While Renting the First

Understanding how to buy a second home and rent the first starts with understanding your financing options. Unlike your first mortgage, which may have been secured as a primary residence loan, your second home loan might come with stricter terms. Buying a second home and renting out the first requires careful financial planning, as lenders will assess your ability to manage two mortgages.

Below are the mortgage options for a second home:

- Conventional Loan: If you’re purchasing a second home for personal use, you can get a conventional mortgage with a 10%-20% down payment. However, you may need to prove that you can carry both mortgages without monthly rental income.

- Investment Property Loan: If your intent is primarily to rent out your first home, lenders may require an investment property mortgage, which often has higher interest rates and down payment requirements (typically 15%-25%).

- Cash-Out Refinance: If you have significant equity in your first home, you can refinance it to pull out cash for the second home purchase.

- Home Equity Loan/Line of Credit (HELOC): A HELOC allows you to borrow against your home’s equity without refinancing.

Understanding your loan options is important as your lender will determine whether your second home is classified as a true second residence or an investment property.

3. Rental Considerations for Your First Home

Once you’ve secured financing, you need to prepare your first home for rental. Renting out a property is more than just collecting rent; it requires an understanding of landlord responsibilities, tax implications, and property management.

To prepare your home for rent:

- Determine Market Rent: Use rental platforms and local market data to determine a competitive rent price

- Screen Tenants Carefully: Perform background checks, credit checks, and employment verification

- Prepare a Lease Agreement: Outline rental terms, security deposit rules, and maintenance responsibilities

- Consider Property Management: If you don’t want to handle tenant issues yourself, hiring a property management company can be a good investment—just be sure to research potential property management fees first

Treat your first home as a business by ensuring proper documentation, screening tenants thoroughly, and setting clear lease terms.

4. Tax Implications of Renting Out Your First Home

Turning your first home into a rental property comes with tax benefits, but also with responsibilities. The IRS has specific rules regarding rental income, deductions, and capital gains taxes when you eventually sell the property.

Below are some key tax considerations to keep in mind:

- Rental Income: Any rent you collect must be reported as taxable income.

- Deductions: As a landlord, you can deduct mortgage interest, property taxes, depreciation, repairs, landlord insurance, and other rental-related expenses on your taxes.

- Depreciation: The IRS allows you to depreciate your rental property over 27.5 years, reducing your taxable rental income. However, the Home Sale Exclusion allows you to exclude up to $250,000 (single) or $500,000 (married) of capital gains from taxes if you lived in the property for at least 2 out of the last 5 years before selling.

- Capital Gains Tax: If you sell your rental property after converting it, you may be subject to capital gains tax on the profit. However, a 1031 exchange can help defer taxes if you reinvest the proceeds into another property.

Consult a tax professional or use an online accounting software like Ledgre to maximize your deductions and understand the tax impact of your rental income.

5. Managing Two Properties Simultaneously

Owning two properties (one as your residence and one as a rental) requires careful management to ensure profitability and minimize stress.

Here are a few things to consider:

- Automating Rent Collection: Use property management software to streamline the rent collection process.

- Scheduling Regular Maintenance: Preventative maintenance reduces potential costly repairs.

- Keeping an Emergency Fund: Unexpected repairs, maintenance costs, or vacancies can impact your positive cash flow. Prepare for these by building and maintaining an emergency fund.

- Staying Updated on Landlord-Tenant Laws: Local laws govern eviction procedures, security deposits, and lease agreements.

- Income and expense tracking: By closely managing your profits and losses, you can avoid unexpected losses and identify opportunities for savings.

Proper management ensures your rental property remains an asset rather than a financial burden.

The Bottom Line of Renting Your First Home

If you were wondering, “Can you own a house and rent another?”, the answer is a resounding yes, if you take the right steps to ensure financial stability and compliance with tax laws. Buying a second home and renting the first can be a profitable strategy if done correctly. By securing the right financing, preparing your home for tenants, understanding tax implications, and managing both properties effectively, you can create a stable source of passive income and long-term wealth.